Using AFO 451 ('Prepare print functions and borrower-related batch jobs'), borrower categories can be automatically modified based on the borrower's age. This activity must be performed once each month.

Using this menu option, you can define a table on the basis of which the system can determine the modifications in the borrower categories.

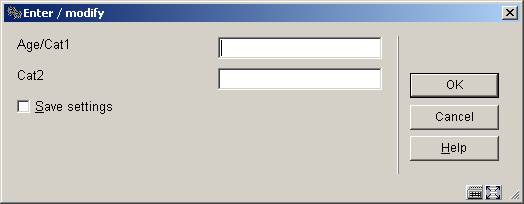

When you select this menu option, an input screen will be displayed. If automatic modifications have already been defined, a survey screen will be displayed.

Age/Cat1.: Enter an age followed by an existing borrower category; separate the two values using a "/" (slash).

Example

65/VW

Cat2: Enter the borrower category to which the borrower will belong after reaching the age defined in the previous field.

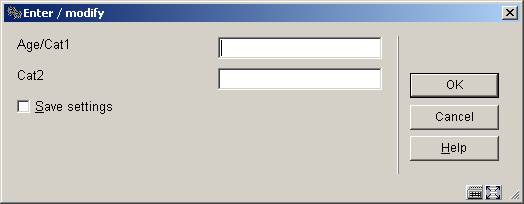

After you have entered the values, an overview screen will be displayed.

: Select this option to define a new borrower category. When you select this option, an input screen will be displayed. This screen is explained above.

:Select a change and then this option to update the information for the category modification.

Select a change and then this option to delete the information for the category modification.

Note

It is extremely important that the data in the table be checked thoroughly. If the update of the borrower category is performed using the wrong information (the table in AFO 482), correcting the resulting errors can be extremely time consuming.

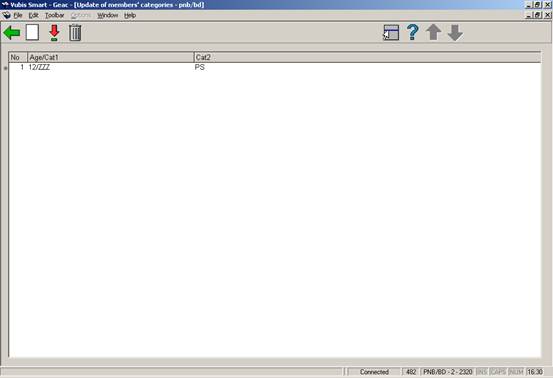

The fields selected on the Data to be entered form are shown when a new borrower is added or copied in AFO 431 Borrower maintenance. The group names and the field names displayed here are those previously defined In use in the Borrower Definition Settings.

After choosing this option the following form will be displayed:

·

Select the fields on the left hand side

·

Click the Right arrow to enter them for display.

·

Use the Up and Down arrows to determine the order for display

You can select more than one field at a time.

The fields selected on the Data to be corrected form are shown when an existing borrower record is updated in AFO 431 Borrower maintenance. The group names and the field names displayed here are those previously defined In use in the Borrower Definition Settings.

See section 482.5 Data to be entered for an explanation.

Use this menu option to link a description to the borrower categories (codes). This description can be displayed in instances including on the cash register overviews.

Category: Enter a borrower category.

Wording: Enter the description of the borrower category as it is to be displayed on the cash register overviews. If the cash register overviews are printed on paper with 80 characters per line, the description may not be too long.

When the description has been entered, an overview screen will be displayed.

: Select this option to enter a new description. When you select this option, an input screen will be displayed. This screen is explained above.

: Select a description and then this option to modify the description.

:Select a description and then this option to delete the description.

Use this menu to allow the system to automatically determine the borrower code when entering new borrowers in AFO 431 ('Borrower administration'). Automatic category determination is performed based on age.

Note

The system has a general default value that is defined using AFO 481 ('Control of circulation parameters: general') with the option 'Defaults'.

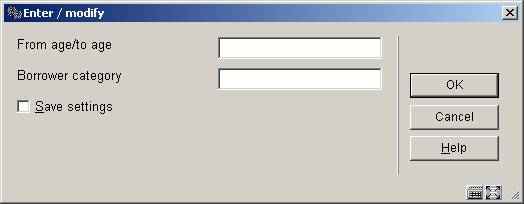

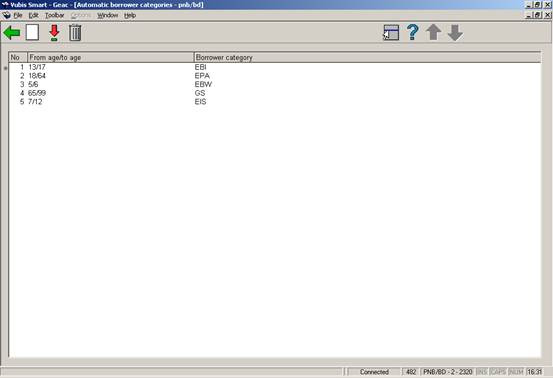

After choosing this option the following form will be displayed

From age/to age.: Enter two ages in this field separated by a "/"(slash). These ages indicate the lower and upper limits, respectively, of the age of borrowers to be included in the selected borrower category.

Borrower category: Enter the borrower category code to be assigned to borrowers in the age range as indicated.

When the information has been entered, an overview screen will be displayed.

: Select this option to define a new age range. When you select this option, an input screen will be displayed. This screen is explained above.

: Select an age range and then this option to modify the borrower category.

:Select an age range and then this option to delete this information.

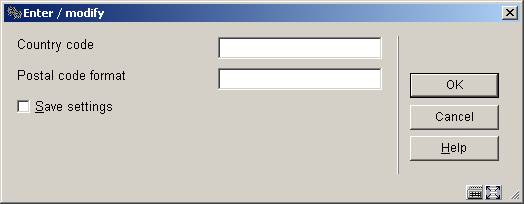

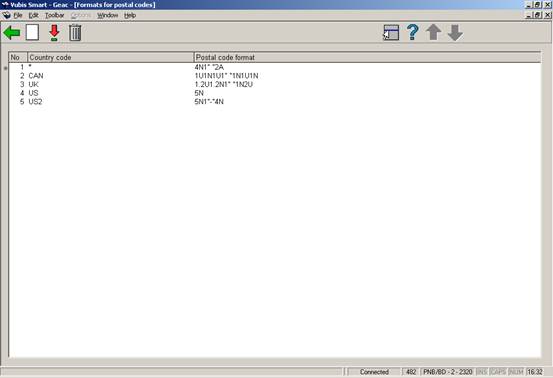

Use this menu option to allow the system to recognise the format of postal codes for various countries.

After choosing this option the following form will be displayed:

Country code: Enter the country code to which the format is to pertain in this field. Enter a "*"(star) for the country in which the system is installed.

Postal code format: Enter the format for the postal code in the country indicated. Enter a string consisting of one or more of the codes in the table below. Enter the codes in the sequence to be included in the postal code.

|

Code |

Meaning |

|

nA |

the postal code contains letters, by which n indicates the number of letters |

|

nN |

the postal code contains digits, by which n indicates the number of digits |

|

n "character(s)" |

the postal code contains specific characters, by which n indicates the number of times that the character occurs and by which the characters are preceded and followed by "" (quotation marks) |

When the information has been entered, an overview screen will be displayed.

Select this option to enter a new format. When you select this option, an input screen will be displayed. This screen is explained above.

Select a format and then this option to modify the format of the postal code.

:Select a format and then this option to delete the format.

Borrowers can be sent an accept giro for payment of the membership fee. This principle is explained in detail in the description of AFO 451. In simplified form, the principle is as follows: accept giros are sent to all borrowers whose membership cards expire in the month for which accept giros are being sent.

This automatic principle can be influenced. The borrower record includes an 'AC' (accept giro) sub-field with the membership fee data for this purpose. If a code is entered in this field, no accept giro (or direct debit order) is sent to this borrower.

Use this menu option to define the applicable codes.

Entering a code in the AC field also affects the automatic renewal of the validity of a membership card. See also the description for AFO 451.

After choosing this option the following form will be displayed:

Code: Enter an accept giro code in this field.

Note

This code may consist of a maximum of four characters.

Explanation (+ automatic renewal/open subscription): Enter the three parameters in the table below in this field. Separate the description and the other two parameters using a "#" (number sign). The other two values are not to be separated but entered directly after one another.

|

No. |

Meaning |

Comment |

|

1 |

Description of the code |

|

|

2 |

Renewal of the membership card |

"0" (zero) if the membership card is not to be automatically renewed; "1" (one) if it is |

|

3 |

Create membership fee |

"0" if no membership fee is to be created in the relevant batch process, "1" if it is to be created |

Note

If no indications are included in the descriptions, a value of "00" is automatically assigned. This means that the card is not automatically renewed and no membership fee due is created.

When the information has been entered, an overview screen will be displayed.

: Select this option to define a new accept giro code. When you select this option, an input screen will be displayed. This screen is explained above.

Select an accept giro code and then this option to modify the meaning of the code.

:Select a code and then this option to delete the code.

In most systems you will allow borrowers registered at one location to borrow from other locations. However, you can restrict where borrowers are allowed to borrow from. For each location, you can define which locations borrowers can borrow from.

After choosing this option the following form will be displayed:

Enrolled in: Enter the location where the borrower is registered.

Permitted to borrow in: Enter one or more locations in this field, separated by a "," (comma), where the borrower may loan items. Use the formats indicated below:

|

"[Agency code]"/"[location code]" |

the borrower may loan items at this location |

|

"[Agency code]"/"*"" |

the borrower may loan items at all locations within the agency |

|

* |

the borrower may loan items at all locations within all agencies |

Enter a message to be displayed at the point in time when a borrower in the relevant borrower category is identified.

When the information has been entered, an overview screen will be displayed

: Select this option to enter a new authorisation. When you select this option, an input screen will be displayed. This screen is explained above.

:Select an authorisation and then this option to modify the locations where the borrower may loan items.

:Select an authorisation and then this option to delete the authorisation.

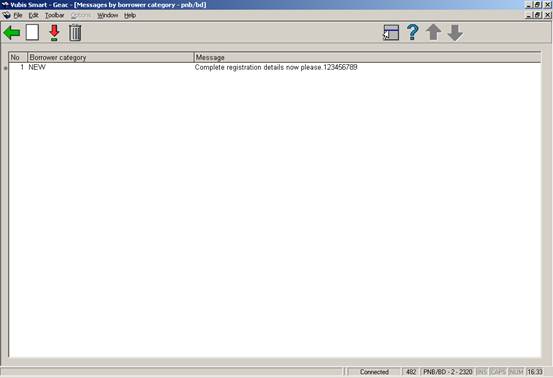

Use this menu option to enter a message to be displayed in nearly all circulation AFO’s for borrowers in the relevant borrower category.

After choosing this option the following form will be displayed:

Borrower category: Enter a valid borrower category.

Message: Enter a message to be displayed at the point in time when a borrower in the relevant borrower category is identified.

When the information has been entered, an overview screen will be displayed.

: Select this option to enter a new message. When you select this option, an input screen will be displayed. This screen is explained above.

:Select a message and then this option to modify the message.

:Select a message and then this option to delete the message.

With this option you can specify in which locations items from other locations may be processed.

After choosing this option a submenu will be displayed:

The parameters are similar for all four options. But the authorisations can be different for each function.

After choosing this option the following form will be displayed:

Location: Enter the location to which to authorisation applies.

May process objects belonging to location(s): Add one or more locations of which this location may process items. Separate the locations by a “,”(comma).

When the information has been entered, an overview screen will be displayed.

: Select this option to enter a new code. When you select this option, an input screen will be displayed. This screen is explained above.

:Select a code and then this option to modify the code.

:Select a code and then this option to delete the code.

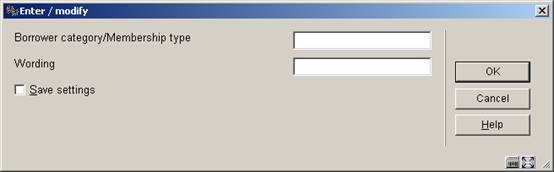

A 'subscription type' can be linked to each borrower record. This type can be used to specify two parameters: the duration and loan conditions pertaining to the maximum quantities.

In order to specify the latter, a table can be defined in AFO 482. In this table, combinations of borrower categories and subscription types can be defined. Special loan conditions with reference to maximum quantities are then applicable to the combinations included in the table; the actual maximum quantities are defined using AFO 481 ('Circulation parameters: general').

After choosing this option the following form will be displayed:

Borrower category/membership type Enter a borrower category and a subscription type, separated by a "/" (slash).

Note

Only one alternative maximum can be defined per borrower category.

Wording: Enter a description of the alternative maximum in this field.

When the information has been entered, an overview screen will be displayed.

: Select this option to enter a new alternative maximum. When you select this option, an input screen will be displayed. This screen is explained above.

:Select a maximum and then this option to modify the maximum.

:Select a maximum and then this option to delete the maximum.

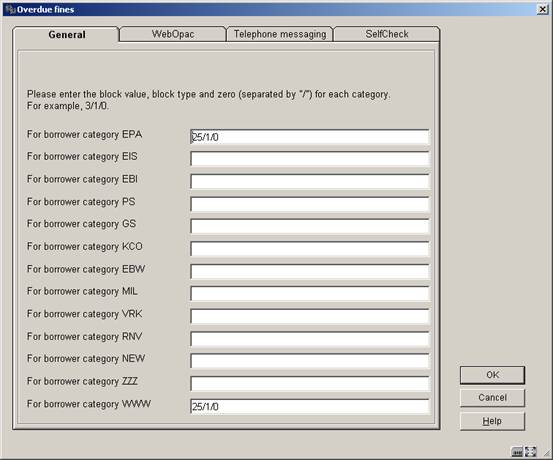

Membership cards can be automatically blocked. In order to do so, a batch process can be periodically started automatically using AFO 451 ('Prepare print functions and borrower-related batch jobs') that checks all borrower records and automatically blocks or unblocks them.

See also AFO 431 ('Borrower administration') for an explanation of automatic blocking and for a comparison with the other blocking possibilities, and AFO 451 ('Prepare print functions and borrower-related batch jobs') for more information about the batch process. Using AFO 482, the various criteria to be applied for automatic blocking can be defined. You can define this separately for WebOpac, telephone messages and SelfCheck.

After choosing this option a submenu will be displayed:

The various criteria that can be applied to automatically block borrowers are displayed in this screen.

Select the desired criterion from this overview. The method is the same for all of the criteria.

After a selection has been made, an input form will be displayed

For borrower category: Enter the following three parameters for each borrower category, separated using a "/" (slash)::

The 'block value'

this parameter indicates the value at which the block is to be effectuated (e.g. if the fine is greater than n or if the membership card expired more than n days ago).

The 'block type'

this parameter indicates the 'hardness' of the lock: "0" means that anyone can cancel the lock; "1" means that the lock can only be cancelled with 'password overwrite', and "2" means that the lock cannot be cancelled.

A parameter reserved for use in the future which should preferably always be defined as "0" now.

Enter the blocks on each tab, insofar as this is required.

The block value must be defined as follows:

|

Criterion |

Block value |

Example |

|

Overdue fines |

Amount |

12.50 |

|

Current fines |

Amount |

7.50 |

|

Overdue + current fines |

Amount |

20 |

|

Acceptgiro sent |

0/1/2 comma number of days |

1,7 |

|

Expired membership |

number of days |

7 |

|

Overdue items |

number of days |

30 |

|

Outstanding payment overdue |

number of days |

30 |

|

Abnormal returns |

Quantity |

20 |

|

Total amount due |

Amount |

30.00 |

|

Outstanding fines overdue |

number of days |

60 |

|

Period after sending overdues |

1/2/3/4 comma number of days |

3,7 |

|

Invoice status |

[Not yet in use] |

- |

|

Items returned too late |

number of days |

7 |

|

Outstanding loan fees |

amount |

2.00 |

|

Outstanding payment overdue, minus membership fees |

amount |

10.00 |

Explanation of a few exceptional cases:

·

Acceptgiro sent

-

Enter the number of days after which an accept giro has been sent after which the borrower is to be blocked. The accept giro is defined as "0" (actual accept giro), "1" (first reminder) or "2" (second reminder).

·

Expired membership

-

Because the system works per month when collecting the membership fee and calculating the expiration date of a membership card (in essence, the membership card expires in a certain month, not on a certain day), calculation of this block is related to the last day of the month in which the membership card expires.

Example

If the borrower’s membership card expires on 9 March 1996 and you want to block the card seven days after the expiration, the block will start on 7 April instead of on 16 March.

·

Period after sending overdues

-

Specify the number of days after which reminder has been sent that the borrower is to be blocked. The reminder is indicated by means of a “1”, “2”, “3”, or “4” (first, second, third or fourth reminder).

·

Items returned too late

- Blocks based on this criterion are considered exceptional cases. Unlike the other types of blocks, this block is created on-line, not based on a batch process in AFO 451 and is re-evaluated as part of the standard block check when the borrower record is assessed for loans, renewals, and reservations. Also unlike other block values, this type is either ON if there is a numeric value in the table or OFF if the value in the table is null or not defined. The function of this block is as follows: if a borrower returns an item n days after the due date, he or she is blocked for a period of n days calculated from the return date. Closed days between the original due date and the actual return date are not taken into consideration. Any repeat violations do not have a cumulative effect; in other words, each return of items by which the due date has been exceeded will result in the calculation of the block period, by which the longest block period is applied.

Below is an explanation of how to set block type 13 ("Items returned too late") and what the subsequent behaviour of the system is.

|

AFO482 -

Borrower Blocks / items returned too late |

The value here is any numeric value / 1/ 0 (i.e. 1/1/0 and 999/1/0) or null. If there is any value entered into the matrix, then the block is ON. If the value is null, the block is not applicable for the borrower category / location. Any numeric value entered means the block is ON, the numeric value itself is NOT a limit. The number of days you are blocked is determined by the difference (not including closed days) between the return date and the original due date. The general level setting is applied to the other levels (WebOpac, SelfCheck, Telephone Messaging) only if the other levels are NOT defined as in use. If the other levels are defined as in use, the any null value will be ignored for block setting, any other value will be assumed active. |

|

AFO481 – WebOpac - Active Block Types |

If this is defined as in use, then ONLY the block types listed are used for the setting of blocks. If Block type 13 is in use and Active, then the system will look at the 482 Block parameters – tab WebOpac settings first. If these are in use, then they are applied as defined. If they are NOT in use, then the general settings are used. |

|

AFO481 – Miscellaneous - Circulation Workflow - Borrowers - Block types |

As with all blocks, it is applicable ONLY if the block is in the right hand (active) column. |

|

Setting the block |

A block is placed on the borrower during returns (AFO412) or if item is loaned to a different borrower in AFO411. The block duration is the longest period during the return session if multiple items are returned. Example: if you have an item 3 days overdue, and one 10 days overdue, the block period is 10 days from today. Block duration does not take into account closed days (regular or variable). If a Block type 13 is currently set on the borrower record (e.g. For 3 more days) and additional items are returned with longer overdue periods the block is NOT recalculated. A Block is placed on the levels defined as active / with values in AFO482 – Block parameters - Items returned too late. Once again, if the subsidiary tabs are in use, then the values on those tabs are used. If they are not designated as in use, then the General settings are applied to all levels. |

|

Clearing / Resetting the block |

Resetting the block is done when the borrower block status is checked. The system will now go through all 4 levels to see if current block (when defined)

needs to be reset. Access points for block check are: Circulation functions such as AFO's 411, 413, 416, 419, 421, etc. where the block level is checked WebOpac functions: Place reservation and User activities / Renewals. |

Other Notes:

AFO451 does NOT look at these levels at all for Block 13 – Items returned too late

·

If the date for expiry of the block = today or in the future: Borrower is blocked.

· If the date for expiry of the block = yesterday or in the past: Block is removed.

When setting the AFO482 Block parameters, the second value is used (overridable or not overridable).

The WebOpac does NOT check the block value / determine active update when displaying personal information (i.e. to see if Change data button should be ON) or when Logging in to User activities (i.e. to see if Alerting services should be on). It is only checked / possibly cleared when the user attempts to create a new reservation or renew item(s) currently on loan.

·

In case there are more than 15 borrower categories, there will be a button to go to the next screen.

· The button allows you to go directly to a specific borrower category.

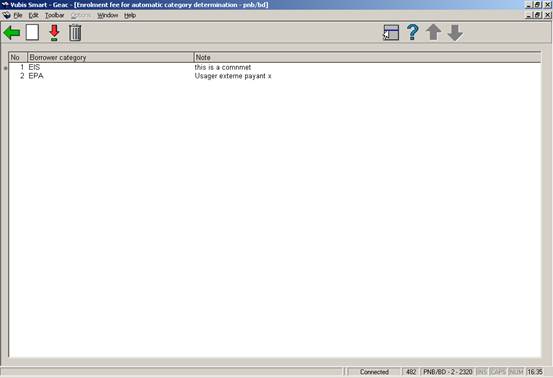

If you so desire, the system can calculate a registration fee (again) when a borrower changes borrower category as a result of a borrower category update (in AFO 451). This menu option can be used to define the categories for which a registration fee is charged in the event of an update. See the explanation for ‘Registration fee’ in AFO 431 (‘Borrower administration’) for more information..

After choosing this option the following form will be displayed:

Borrower category: Enter the borrower category. This pertains to the category to which the borrower belongs after the automatic update (in other words: the new category).

Note: Enter any comments in this field.

When the information has been entered, an overview screen will be displayed.

: Select this option to enter a new borrower category.

Select a borrower category code and then this option to update the comment.

:Select a category code and then this option to delete the category.

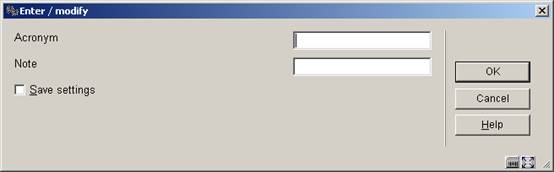

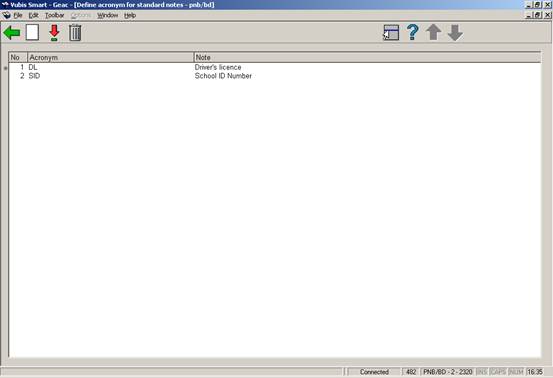

After choosing this option the following form will be displayed.

Acronym: Enter a code.

Note: Enter a free text description.

When codes already have been defined, an overview screen will be displayed.

: Select this option to enter a new code. When you select this option, an input screen will be displayed. This screen is explained above.

:Select a code and then this option to modify the code.

:Select a code and then this option to delete the code.

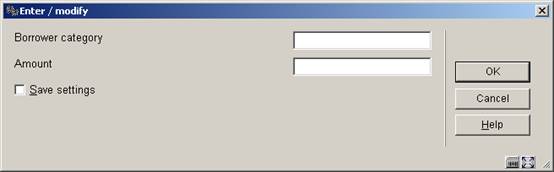

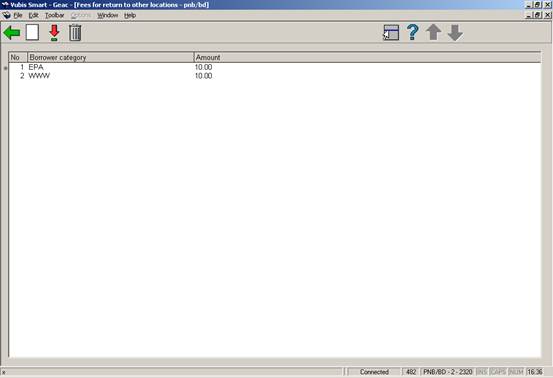

This menu option can be used to define a fee per borrower category for returning items at a location other than the location where the item was lent.

After choosing this option the following form will be displayed.

Borrower category: Enter the borrower category.

Amount: Enter the amount to be paid when an item is returned at another location.

When amount have already been entered, an overview screen will be displayed.

: Select this option to define a new borrower code and an amount.

:Select a borrower code and then this option to update the amount.

Select a borrower code and then this option to delete the code and the amount.

This option can be used to indicate that the membership card for a certain borrower code is to be automatically renewed on the expiration date if the borrower has lent an item in the past n days. This option can be used, for example, to identify non-paying members who have moved or who no longer use the library.

After choosing this option the following form will be displayed:

Borrower category: Enter the borrower category.

Renew if last loan date <n days In this field, enter the number of days prior to the expiration date within which a borrower must have lent an item in order to automatically renew the membership card.

When codes have already been defined, an overview screen will be displayed.

: Select this option to enter a new borrower category and a new number of days.

Select a borrower code and then this option to update the number of days.

:Select a borrower code and then this option to delete the code.

With this option you can specify whether or not the post code table is in use.

After choosing this option the following form will be displayed:

This table contains the defined postcodes.

With this option you can specify how phone numbers must be entered in a borrower’s record. If nothing has been defined here, phone numbers can be entered in any format.

The following values are valid:

·

.N(.iN1” “).1(jN1” “)kN

·

.1(iN1” “).1(1”0”.jN1””)kN

·

.1(.iN1” “).1(1”0”jN1” “)kN

where i,j,k = 1 to 9

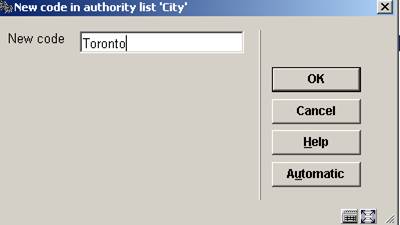

Borrower authority lists are the list codes that the user can use when creating or modifying various aspects of the borrower data. Whenever a drop down select list appears, it is utilising a borrower authority list.

After choosing this option the following form will be displayed:

This window asks you to select the borrower authority list to modify.

Note

The lists themselves can not be created by the library. These come with the system. If you want another list added, you need to contact Infor.

. Once a list is selected the following form appears. There are three columns in the display: Wording, Code and "In use". Wording refers to the data displayed in the select list and is dependant upon the current language you are using. Code is the code that is inserted into the borrower record. “In use” indicates whether or not to display the value in the select list:

: If you select the "create new entry" icon the following form appears. The name given is the data that will be inserted. Once a unique name is given, a blank record entry screen is displayed.

Enter a code or click on to have the system generate one.

If you double-click an entry, the modify record form appears. Data appears as a Marc type record as shown by the following screen. The value entered in the 100 tag for the various languages is the wording used in the select list. The value entered in the 600 tag indicates whether to display the value in the select list or not. Note only 1 or 0 is valid.

:Select a code and then this option to modify the code.

:Select a code and then this option to delete the code.

Note

One of the standard authority lists is ‘Language’. This can be used for statistical purposes as well as for notice production. Currently supported languages for notice production are: Dutch, English, German, French, Spanish, Romanian, Papiamento. If the standard 3-letter code for any of these languages is entered in a borrower record, the notice for that borrower will be sent in the appropriate language. In order for this to work, the code must actually be the international 3-letter abbreviation for the language in question (although what you see in the borrower record is the wording). I.e. it will not work if your authority list uses: CODE = 1, wording = English; CODE = English, wording = English; CODE = en, wording = English etc.

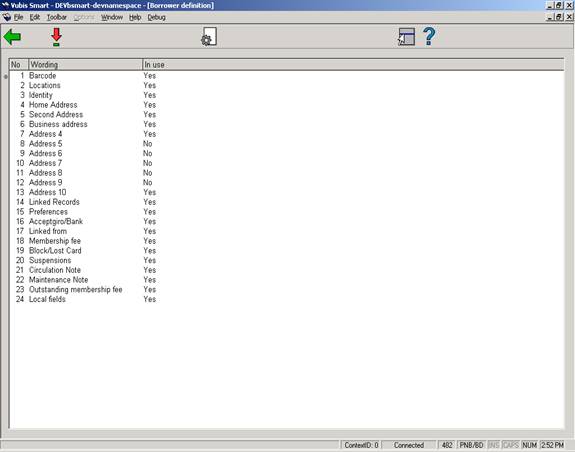

The Borrower definition settings define how data is entered into the borrower record.

All information relating to the borrower is contained in these fields so you must ensure that you define all those you wish to use.

The data may just be used for display purposes, or for contacting the borrower and sending out notices. The borrower category determines the borrowing privileges of the borrower.

Some fields are used for management information purposes, such as Ethnic origin or Statistical category.

Once you have decided which fields you want to be included in the borrower record you must then decide which fields you want to be presented when you register a new borrower, and which fields can be modified by the user.

In order for a group to be visible on the Borrower Detail screen, and for setting the parameters Data to be entered and Data to be modified, you must set it to be In use = Yes.

After choosing this option, an overview screen will be displayed with codes already defined:

: Select a code and click this icon to view the fields belonging to this group.

: Select a code and click on this icon to view the properties of that field.

·

Enter the wording you want for the field

·

Check the In use/active check box

·

Check the Mandatory check box if you want this field to be filled in for every borrower

·

Check the Copy field if you want the data in this field to be copied to a new borrower record when you use the Copy Borrower function

·

Select a Data type from the drop-down box. The default is Text.

Caution: if you want to change the Data type please contact Infor for advice.

·

You can enter default data that will be filled in for the field for each new borrower.

·

Cache Format Pattern is any valid Cache Object Script pattern

·

Select an option from Automatic format conversion (not mandatory)

·

Select a Standard Validation Test if applicable (You can ignore this option)

·

If relevant you can an select an Authority List which is linked to the authority list behind the field

Note

If a field has data in it and the field is set to In use/active then it is displayed in the AFO 431 main display, just not in the update screens.

: Select a code and click on this icon to set the code to “In use”. This option is the same on both screens.

· The In use/active checkbox will only be available if this field is not selected in the Data to be entered and Data to be corrected screens.

With this option you can control the content and format of the borrower name as it appears in various places within the application. Separate formatting is available for display, printing and indexing.

After choosing this option the following form will be displayed:

The column on the left contains the available fields that have not been selected. The column on the right contains the valid fields that have been selected. To add an entry to the selected list, select an entry in the left column and click the right arrow button (→). To remove an entry from the selected list: select an entry from the right column and click the left arrow button (←). To change the order of selected fields, select an entry from the right column and use either the up arrow button (↑) or the down arrow (↓) to move the entry before or after the other selected entries.

The valid name fields are: last name, last name prefix, first name, middle name, initials, last name prefix/title, suffix/title. Before a given field can be used it must be made available. Selecting the “Borrower Definition Settings” in AFO 482 does this. The fields are located in the “Identity” entry. For any entry you wish to use you must select an entry, make sure the “In use” checkbox is checked and save the changes.

The ‘Display’ setting is also used to determine the display of a borrower name in the title bar, when the borrower is logged on to User Activities in the WebOpac.

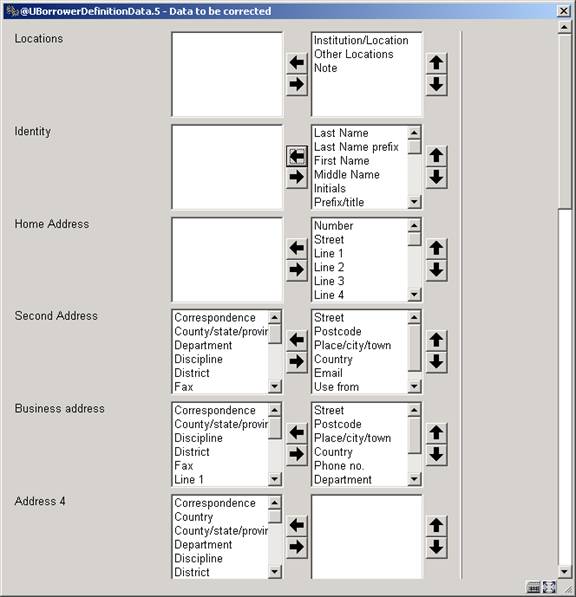

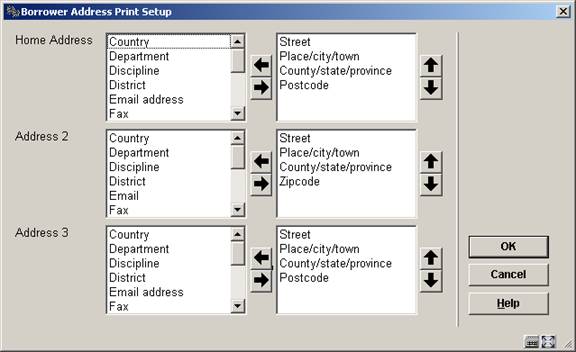

The library can define up to ten addresses for the borrower. Each of these addresses is given a name (i.e. Home Address, Address 2, Address 3, etc) and within each address, the library chooses which fields are “in use” – see the Borrower Definition Settings section for more details. For each borrower address that the library uses, the library can define which fields appear in the address and how these fields are formatted.

After choosing this option the following form will be displayed:

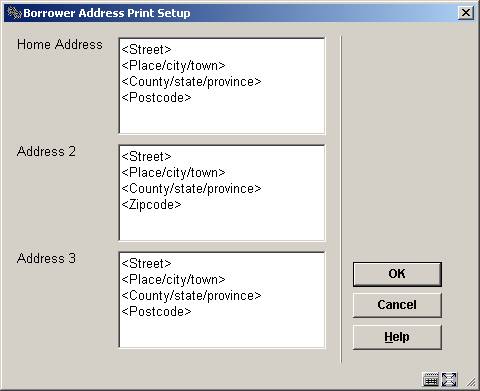

The form above includes each of the borrower address groups that is “in use” by the library. In this example, only three addresses are “in use”. For each group, the middle column shows the fields that are “in use”. These are the fields that the user can choose for the address print. To select a field, highlight it in the middle column and then push if over to the right hand column. Use the up and down arrows to change the order in which the fields display. When the fields have been selected for each address, press the OK button. The following form appears.

On this form, each of the selected fields appears within angle brackets. Do NOT remove the angle brackets from the field names.

“Borrower Address SSP Print Set-up” is used to set-up the way the address will be printed on all SSP notices and card format notices (overdue, reservations, manual/automatic recalls). This type of set-up allows multi line address printing. What you see in design mode is what will be printed.

·

For instance:

-

<Line 1>

-

<Line 2>

-

<Line 3>

-

<Line 4>

-

<Line 5>

-

<Place/city/town>, <District>

-

<Postcode>

- <Country>

See the section on Borrower Address SSP Print setup for a general explanation of this feature.

“Borrower Address Print Set-up” is used for all the other type of notices. In this set-up only three lines can be defined. The first line will be the street, the second line will be the city and the third line will be the postcode.

·

For instance:

-

<Street>

-

<Place/city/town>

- <Postcode>

· On each line you can define more than one element. For instance:

-

<Line 1> <Line 2>

-

<Place/city/town>, <District>

- <Postcode>

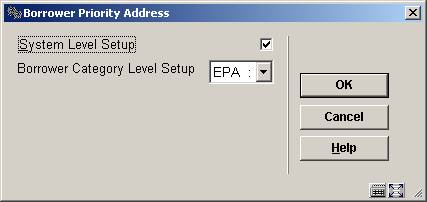

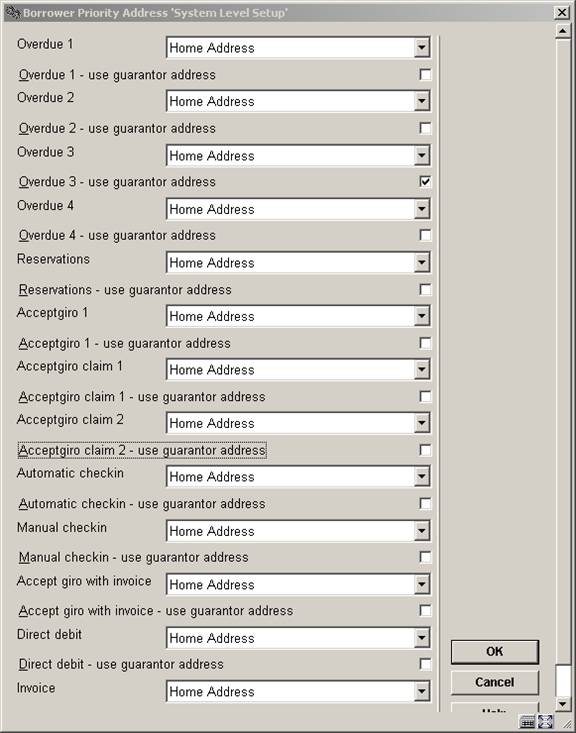

The Borrower address priority set-up is used to determine which borrower address should be used for each system job. There are 13 system jobs: Overdue 1 through 4, Reservations, the Accept/Giro jobs, etc. At the system level, for each of the 13 jobs, the library chooses which borrower address should be used for correspondence and whether the guarantor’s address (if found) should be used. The address priority set-up is also defined at the Borrower Category level. For each Borrower category, the library can choose, for each of the 13 system jobs, which borrower address should be used for correspondence.

Selecting ‘System level set-up’ results in the display of the following for:

For each job, the library can select which address should be used in correspondence. Also, if guarantors are used, the library can decide to override the borrower’s address with that of the guarantor for specific jobs. For example, the library might choose to send the 3rd overdue notice to the guarantor’s address.

Addresses can be set for: overdues 1-4, reservations, acceptgiro’s plus overdues, automatic & manual recalls, acceptgiro’s for invoices, direct debits, invoices, collection agency.

The set-up for a specific Borrower category, if done, overrides the more general system settings.

·

Logic for determining which address to use:

-

The system will check the address set-up at the system level to determine which address to use at the system level for the specific job.

-

The system set-up will be checked in order to see if this job uses the guarantor. If this job uses the guarantor and the borrower has a guarantor, the system will switch to the guarantor’s borrower record. If the borrower does not have a guarantor, the system will stay in the borrower’s record.

-

The system will check if there is an address set-up at the borrower category level. If there is, the system will use this set-up to determine which address to use for this job.

- If this address has “Use from” or “Use until” fields set, it will be checked to make sure that the selected address falls into the correct date range and also it will be checked that the “Use address for” field allows the use of this address for the specific job (if null, address can be used for anything). If this address is valid, starting from this address, the system will determine if there is another address that better qualifies for use (is “Use from” date after previous addresses but before today’s date). If no other address better qualifies for use, this address will be used. If this address is invalid, the system will start at the first address in the borrower record in order to find the address that qualifies best. If no address qualifies, the first address in use will be used.

In the left hand column all address groups in use are displayed.

After choosing this option the following form will be displayed:

· The fields that should be part of the 1 line address display can be moved to the right. The order of the fields can be modified by using the up and down arrows.

In AFO 431, Borrower Administration you have the option to create additional cards for a borrower record. The maximum number of additional cards that can be added is limited by this parameter

After choosing this option the following form will be displayed:

· Enter the maximum for each borrower category.

Note

If nothing has been defined, no additional cards can be created. The relevant button will be inactive on the screen in AFO 431, Borrower Administration.

·

In case there are more than 15 borrower categories, there will be a button to go to the next screen.

· The button allows you to go directly to a specific borrower category.

You can create age groups and relate these to one or more borrower categories. If a borrower category is changed in AFO 431 the system will check the valid categories that correspond to the age of the borrower. If the borrower category is not valid, an error message is displayed. If a borrower category is changed in AFO 431 the system will check the valid categories that correspond to the age of the borrower. If the borrower category is not valid, an error message is displayed.

After choosing this option the following form will be displayed.

·

Add an age group and move the valid category to the right.

If the table contains no entry at all, no age check will be done.

Ages that do not fall in any of the defined age groups have no restrictions on borrower category (i.e. all categories are valid).

Example table:

|

Age group |

Valid categories |

Comments |

|

0-4 |

A,B,C |

|

|

4-12 |

D,D2 |

|

|

13-17 |

E,F,G,H |

|

|

18-64 |

I,J,K,L |

|

|

65-999 |

I,J,M |

Note that borrower categories may appear in multiple age groups (I and J also appear in the previous age group) |

|

* |

X,Y,Z |

No date of birth in the borrower record |

|

+ |

T1,T2 |

Categories that are valid in all cases, independent of whether they figure in age groups. This parameter takes precedence over age related parameters. |

|

- |

T3 |

Categories that are invalid in all cases, independent of whether they figures in age groups. This parameter takes precedence over age related parameters. |

Note

When the system is configured is such a way that an age can fall in multiple categories, the internal global will contain the result of an OR operation. Example:

·

The age categories

-

0-4 – category A,B,C

-

0-6 – category C,D,E,F

·

correspond to the following ages:

-

0 – A,B,C,D,E,F

-

1 – A,B,C,D,E,F

-

2 – A,B,C,D,E,F

-

3 – A,B,C,D,E,F

-

4 – A,B,C,D,E,F

-

5 – C,D,E,F

- 6 – C,D,E,F

When codes have already been defined, an overview screen will be displayed:

: Select this option to enter a new code. When you select this option, an input screen will be displayed. This screen is explained above.

:Select a code and then this option to modify the code.

:Select a code and then this option to delete the code.

Note

This parameter has no relation to any other age category related parameters.

If your library is set up to generate pincodes from date of birth, you can use this option to automatically generate pincodes based on date of birth for borrowers without pincodes when you leave the borrower’s record in AFO 431. These parameters are set at the metaInstitution level.

After choosing this option the following form will be displayed:

Automatically generate pincode from date of birth: set this flag if you wish to automatically generate pincodes when you leave the borrower’s record in AFO 431. This flag should only be set if your library generates pincodes from the date of birth field.

Default pincode if date of birth is not available: enter either a valid date or 99/99/9999.

If the automatic generate flag is set and your PIN generation is based on DateOfBirth and the borrower does not already have a PIN code, the system will automatically generate a pincode (using either the borrower’s date of birth or the default in defined above) when you leave the borrower's record.

Pincodes may also be automatically generated for borrowers entered through the WebOpac.

If you have selected to display the district code for the Data to be entered and Data to be corrected options in AFO 482, a dropdown list will be displayed when adding/modifying a borrower record. This parameter determines what the dropdown list looks like

After choosing this option the following form will be displayed:

District display includes: choose a format from the dropdown list. There are four options:

- only code

- only wording (gives nothing if district is not in authority)

- code followed by wording

- wording followed by code

Punctuation between code and wording: When you choose option 0 or 1 you can specify here what the punctuation between code and wording must be.

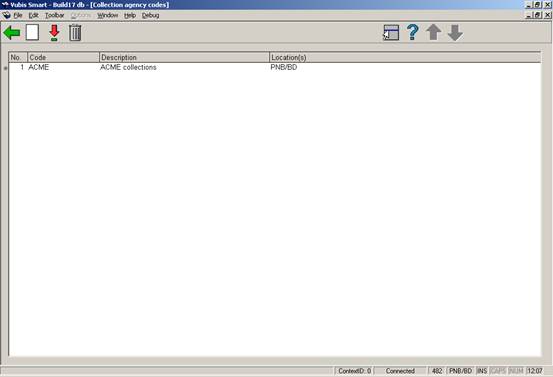

These parameters are stored at the Circulation metainstitution level. Multiple collection agency codes may be set up for each Circulation metainstitution.

After choosing the Collection agency codes option, a screen appears showing you all of the collection agency codes already set up for your Circulation metainstitution:

: choose this option to create a new code. See section 482.34.1.

: choose a code and then this option to modify the details. See section 482.34.1.

: choose a code and then this option to delete the code.

After choosing the or option an input form will be presented:

Collection code: a unique code for this collection agency. When updating an existing code, this field will be protected (i.e. once a code has been added, you can not modify the code itself).

Description: a brief description of the collection agency.

Locations to link: combo box showing list of institution/location combinations (including institution/* to select all locations for a specific institution). If an institution/location combination is already linked to another collection agency code, the list will not include this combination. Select a location and use the arrows to move it.

Exempt fee types: combo box showing list of fee types that are not collected by the collection agency. Select a fee type and use the arrows to move it.

Monetary threshold: If a Borrower's aged aggregate amount owed (see Aging and Grace period parameter below) equals or exceeds this value, the Borrower's bills and invoices will be sent to the Collection Agency for collection. The aggregate amount is calculated only from fee types not included in the Exempt fee types field.

Collection fee: On going to collection, an additional processing fee will be added to the existing invoices.

Aging parameter (in days): (i.e. 6 years = 2189). Invoices, fines and other payable amounts older than this criteria will be ignored.

Grace period (in days): (ignore current invoices within X days). Invoices, fines and other payable amounts more recent than this will be ignored.

Exempt borrower categories: list of borrower categories that are exempt (e.g.: Staff, Bankruptcy). Select a borrower category and use the arrows to move it.

Email address: enter the email address of the Collection Company to which reports must be sent.

·

Document control - Change History

|

Version |

Date |

Change description |

Author |

|

1.0 |

March 2006 |

creation |

|

|

2.0 |

May 2006 |

updates for release 2.4.1 build 16 |

|

|

3.0 |

September 2006 |

updates for release 2.4.1 build 17 |

|

|

4.0 |

November 2006 |

changed terminology; added explanation of language code usage |

|

|

5.0 |

April 2007 |

added more info on borrower name display |

|

|

6.0 |

May 2007 |

minor updates |

|

|

7.0 |

November 2007 |

added explanation of how to set block type 13 ("Items returned too late") delivered as part of 2.4.2.4 updates |

|